As of 16th December 2021, and without warning, the government imposed the latest round of cooling measures. These headlines may have trumped Raeesah Khan’s saga since the news was released. We do not personally think this came as a shock to many, as prices have seen strong appreciation over the recent quarters, albeit slightly earlier than expected. Here is the summary of the measures imposed:

Source: MND.gov.sg

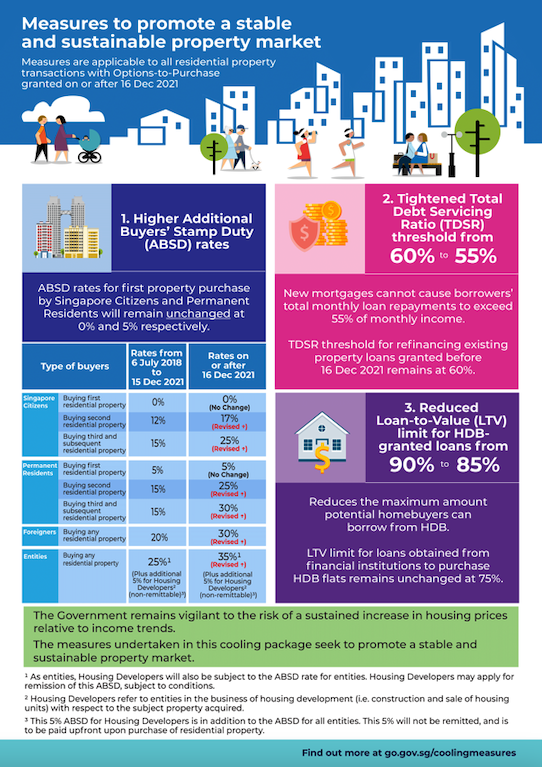

Changes to Additional Buyer’s Stamp Duty (ABSD)

ABSD is a one-time tax on your property, the more properties an individual owns, the more tax is paid to the Government for national development.

Total Debt Servicing Ratio (TDSR) Reduction

TDSR restricts the amount of income usable for your borrowing and hence reduces your purchasable quantum and monthly mortgage. A 5% may not seem significant as it only works out to be only $500 in income. Read on to understand the real impact of this measure.

Revision to Loan to Value (LTV)

LTV ratio affects the maximum amount of loan borrowers can take to finance a property.

Under the new revised LTV ratio, the maximum LTV for HDB Concessionary Loan is reduced from 90% to 85% of the price or value, whichever is lower.

An example will be, if the purchase price/valuation of a resale/BTO is $500,000.

Under the old scheme, the maximum loan amount would have been (500,000 x 90%) = $450,000, with $50,000 being CPF/Cash

With the new measure, the maximum loan amount now would be (500,000 x 85%) = $425,000, meaning borrowers will now need an additional $25,000 CPF/cash for the same purchase.

Financial Institution (FI) financing remains status quo at 75% LTV.

Who’s Affected?

The market has many segments and let us delve into each to have a clearer picture.

Build-To-Order (BTO)

For first-timers looking to finance a BTO may not so much be affected given the level of subsidy provided by the Government already.

Resale HDB

This segment of the market maybe the hardest hit given the quantum of prices are now much higher and buyers have to top-up $5,000 for every $100,000 difference, on top of the potential Cash Over Valuation (COV). Sellers may now need to rethink their listing prices, especially if they are in an urgent need to sell their existing flat to move-on and avoid ABSD.

New Launches

In our opinion, we believe existing new launches may not so much be affected as most of them have been launched in 2019/2020 and are mostly sold. Hence, developers can still adopt a wait-and-see approach.

Yet to be launched developments may be delayed or developers may be forced to launch at a more reasonable price.

In the recent announcement, the government plans to launch new GLS sites and in view of this cooling measures, we could potentially see developers bidding more prudently and hence translation to more affordable launch prices in the future.

Resale Private

The private resale segment is one which we feel may benefit or at least find some price support from this cooling measures.

Source: Singstat.gov.sg

Referencing to official data for 2020, the average household earns close to $10,000. Basing off the 60% TDSR, household purchasing power with a 5% reduction in the Debt Servicing Ratio, we see an 8% drop in purchasing power across the board.

While this is more of a re-distribution of purchasable power, borderline HDB upgraders may find themselves priced out of the New Launch market, especially if location and size are their priorities.

Hence, with WFH expected to be a norm in this day and age, resale private developments may enjoy bolstered demand.

Investors & Foreigners

Finally the last target group of high-net-worth individuals who have the financial capabilities to own multiple properties or purchase ultra-luxury properties in Singapore, a 10% increase in the ABSD will definitely send shivers as they may be paying close to $100,000 in stamp duties alone. Hence, we may see some price corrections in the CCR region.

What’s Next After the Cooling Measures

In conclusion, this bout of cooling measures was to bring stability to the markets through the slow down in influx of foreign money but more so, the resale market segments (especially the HDB resale segment) which saw a staggering 9% growth over 3 quarters.

Source: URA

We are probably going to see a knee-jerk reaction with this announcement, potentially similar to that of 2018 but prices recover healthily as supply has yet to catch up with the demand.

If you are in the market to buy/sell your property, do reach out to us for a non-obligatory consultation to understand your finances and empower yourself with more knowledge to make the most desirable decision for you and your family.

Otherwise, do read on!