In typical Government fashion, 2022 cooling measures were announced close to midnight on the 29th of September and effective on the 30th. As realtors, we were already half expecting some form of cooling measures given the overheated resale markets but this definitely came earlier than expected. Let us take a look at the measures and what we could expect moving forward to close out the final quarter of 2022.

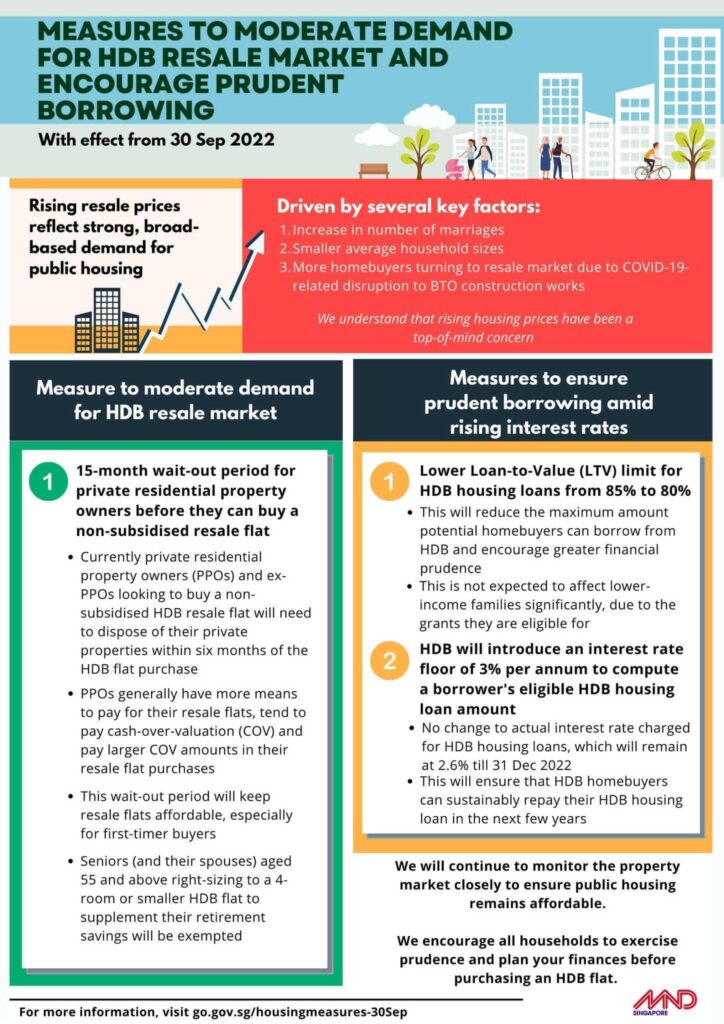

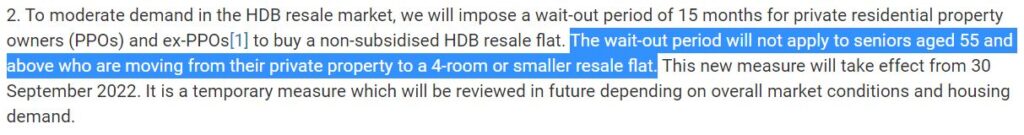

Firstly, a 15-month wait out period has been imposed on PPO (Private Property Owners) before they will be able to purchase a non-subsidized resale HDB, whereas previously, these private owners could choose to purchase a resale HDB first prior to selling their current place 6 months later. Let us term them the ‘downgraders’.

The second measure is increasing the interest base in the computation of loan eligibility, with private properties increasing by 0.5% to 4% and public housing from 2.6% to 3%.

Lastly, the Loan-To-Value (LTV) for HDB loans was reduced for the second time in 2 years from 85% to 80%. This results in buyers now requiring $25,000 more in cash or CPF for a $500,000 resale HDB, which in our opinion is the strongest cooling measure implemented.

Based on the fore-above mentioned measures, it is quite clear the government’s intention is to cool off the resale HDB market which has seen double digit growth y-o-y in the last 2 years.

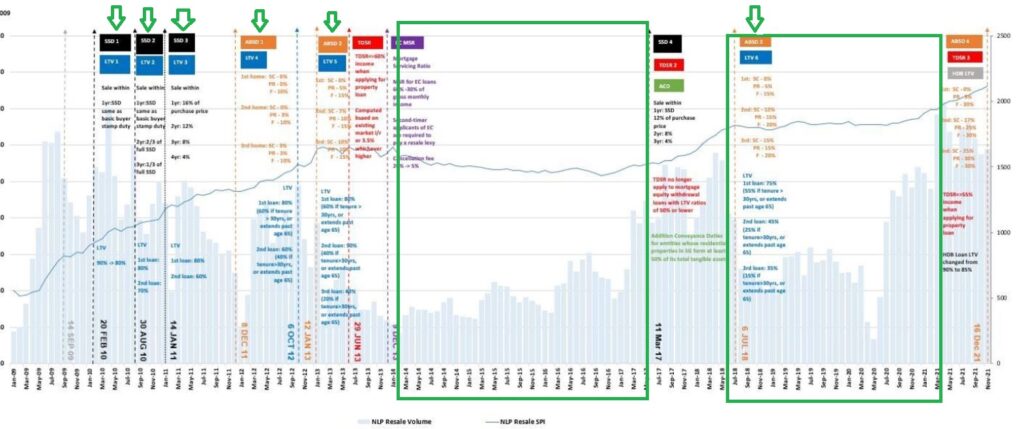

As this is the very first time we have noted such aggressive cooling measures for the resale HDB market, it is anyone’s guess on how the markets will eventually react. Taking reference from the private resale market which had over 13 rounds of cooling measures already.

From the charts, we do note that the markets do enter into prolonged periods of stagnation whenever an LTV cooling measure is imposed.

However, the caveat here is that the private and HDB markets behave slightly differently coupled with the fact the macro environment is very different now and public housing constitutes for 80% of the local demand.

Thus, we feel that we should focus on how these cooling measures will affect the demand side for resale HDB and the 3 main demand drivers we have identified are the ‘HDB upgraders’, ‘PPO downgraders’ & ‘first-timers’.

HDB Upgraders

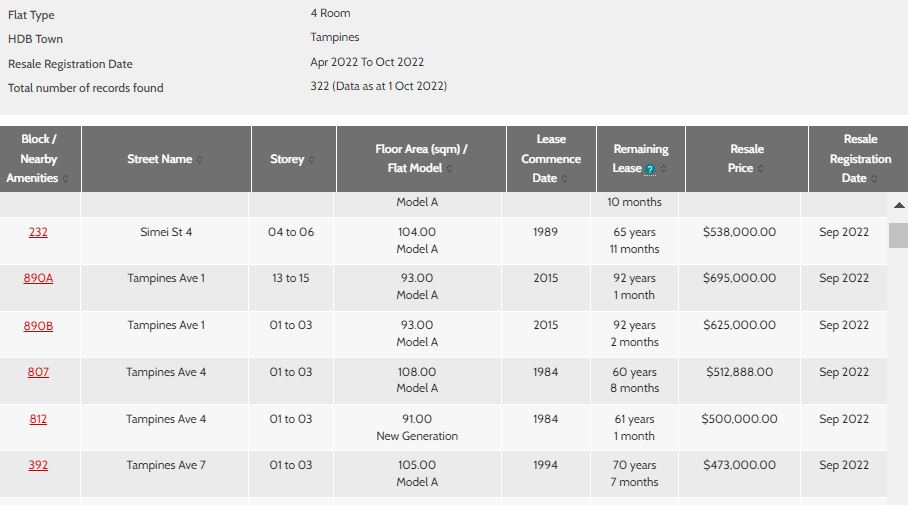

HDB upgraders generally prioritize space and would have sold and (possibly) profited from their existing place to fund their next purchase, thus demand from this group is expected to still be strong. However, we may see demand flow to the older resale units as compared to the newer MOP BTO mainly due to price disparity and space.

As seen from recent transactions of 4-room resales in Tampines, older units have at least 150 sq ft more and are $150,000 cheaper than their younger counterparts.

PPO downgraders

PPO downgraders in our opinion may constitute a significant portion of the demand mainly due to the recent en-bloc fever and the run in private property prices. With this 15-month cooling off period, we are expected to see those stuck in limbo (especially the younger ones), flow into the rental market or back to the private market, thus seeing a boom in these respective markets.

However, we personally feel a bulk of downgraders may fall into the senior age group which then we can probably expect fund flows into the 3 & 4-rooms, which of course may spell trouble for the last group of demand drivers.

First-Timers

The hardest hit of the lot will be the first-time buyers. This group of buyers are mostly young graduates and newly weds and will generally take HDB loans to manage their cash flow. Thus, with the double cooling measures on their loan eligibility and also more cash or CPF required up front, we may similarly see their demand shift more to the older resale units, private resale, the rental market or exit totally.

Given the stickiness of demand, we do expect to see the resale HDB market taper off slightly in the longer run but there may be a window of opportunity for some resale sellers to take action now.

If you are a seller, landlord or someone just generally confused about the market situation, do reach out to us for a non-obligatory assessment of finances to map out options for you and your family.

In closing, we do feel this move by the government has been a good one to continue to keep public housing affordable for the masses without relying just solely on fiscal and monetary policies. Such cooling measures give the government a lot of free play to stimulate the markets at any given time by lifting these measures but as always, we advise all friends and clients to exercise financial prudency and not base any form of borrowings on today’s rates. Especially when the Monetary Authority has already advised we will not be expecting to see similarly low rates in 2023 moving forward.

If you have enjoyed what you have read so far, give us a follow or check out other articles here.